I refer to Intu – the shopping centre people. They have just gone belly up!

They own a number of well known UK shopping centres, like Lakeside in Essex and the Trafford Centre in Manchester. They also own two here in the North East of England, Eldon Square in Newcastle upon Tyne and the Metrocentre in Gateshead. Metrocentre when it opened in 1986 was the largest shopping centre in Europe. It’s not anymore but currently is the second largest in the UK – beaten only by London’s Westfield which has overtaken it since Westfield expanded in 2018.

Metrocentre was built by Cameron Hall developments headed by Sir John Hall, but since 1995 has been owned by the company now known as Intu Properties. But all has not been well at Intu.

They have failed to refinance, KPMG have been appointed as administrators and they are running the Intu shopping centres for now. Intu had a debt of around five billion pounds, and I am not at all surprised that no one would lend money to a company with that much debt, at a time like this. Intu weren’t doing that well before Covid -19, clearly the Coronavirus Pandemic has meant that many businesses world wide have suffered, Intu are no exception. But they lost a lot of money in 2019, a bad year all round for retail. A number of shops have closed or gone out of business, leaving empty units in Intu shopping centres. Many retailers have tried to negotiate cheaper rents to help solve their own liquidity problems, many also are behind with their rent. None of this was good news for Intu. Sadly though it’s the way of the world at the moment. The pandemic has changed the way we shop, with a big increase in Internet shopping, which was already huge and seriously damaging traditional retail.

Now I understand both sides of the argument here. The retailers are struggling too and want to reduce their costs, rent being a significant one. Intu want to keep their rents high, and they are high, because they need the money. But it’s possible to have a lose-lose situation, which is clearly not good, however it’s the route they seemed to have chosen.

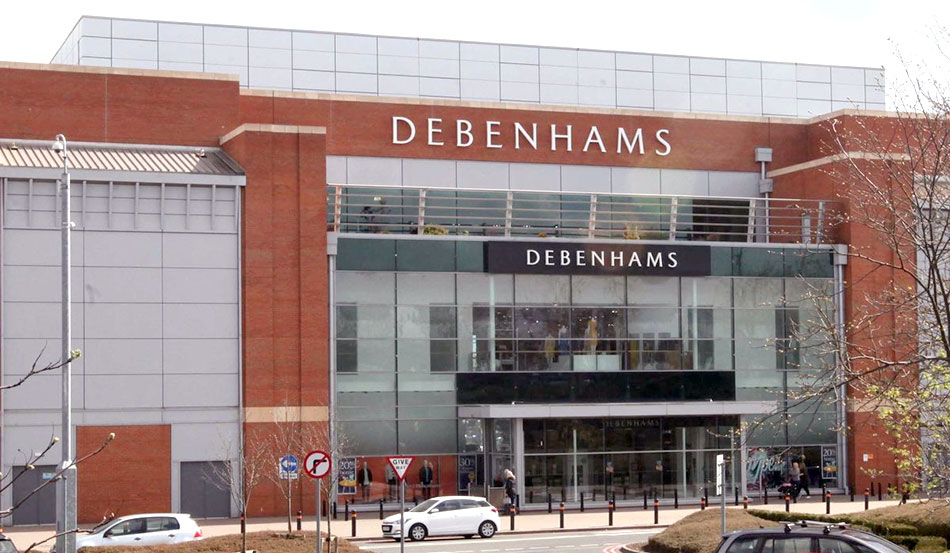

Metrocentre has some large department stores, Marks and Spencer at one end of the centre, Debenhams at the other end and House of Ashley – sorry that’s House of Fraser – in the middle. They also have large Primark and TK Maxx stores, and many others.

Debenhams, one of the few places that stock nice clothes for men these days, have three stores in the North East. One is in South Shields which they have already said will not be reopening. The other two are in the Intu shopping centres at Eldon Square and the Metrocentre. But Debenhams are also in trouble and are renegotiating their rents. Debenhams have been unable to negotiate a new deal with Intu over their large Metrocentre store – they have now said it too will not be reopening and is now ‘Permanently closed’. This is a huge blow for North East Shoppers. The other Debenhams, in Eldon Square only opened from the UK’s lockdown today, Friday 26th June 2020, the day that Intu went out of business!

Everybody has had a tough year, but you would have thought, wouldn’t you, that Intu would have been keen to do a deal with Debenhams. How can they be on the brink of insolvency, and NOT negotiate a deal to keep one or their largest retailers at the Metrocentre? Did they not realise that after they are gone, they would have had a very difficult time letting a retail space of that size? Did they not realise that Debenhams brings people to the Metrocentre, and without them footfall will decrease? How does that make any sort of business sense? Perhaps it is a crazy decision like this that demonstrates why Intu have gone out of business. Even if they had offered to keep Debenhams at a peppercorn rent – well below what they would have preferred – surely they would have seen that as a benefit to the whole of the Metrocentre.

I see the problem. A business that is being badly run, has massive debts, has to put up the rents to help them out of trouble. But it doesn’t work. Even before Covid-19 closed them down instantly, all retailers were having a difficult time. They can not afford exorbitant rents, so can’t pay, making it even more difficult for Intu. But it’s the Spanish mentality. I know of a few restaurants in Spain who were sitting still, with tired menus, slowly losing business. They didn’t understand why they were failing and simply put the prices up, by quite a lot, to recoup some losses. It didn’t work, it just drove the remaining loyal customers away. Intu seemed to be doing the same.

The good news is that KPMG will now be selling the business. Hopefully when the Metrocentre is bought, preferably by a company that is not mired in debt, they will be able to do a deal with Debenhams who will then be able to change the status of Debenhams Metrocentre from ‘Permanently closed’ to ‘Reopening soon’. I certainly hope so, I need a new pair of shorts.